17+ proration of taxes calculator

Welcome to the webpage of Oklahoma County Assessor Larry Stein. View listing photos review sales history and use our detailed real estate filters to find the perfect place.

Cv Escrow How Property Tax Prorations Work In Escrow

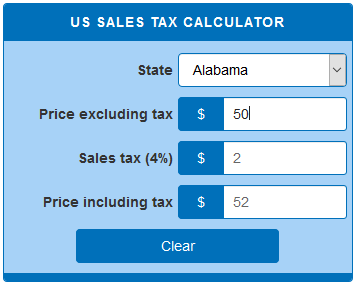

This proration calculator should be useful for annual quarterly and semi-annual property tax proration at settlement calendar fiscal year.

. The seller is responsible for the preparation of. The Zestimate for this house is 76100 which has decreased by 16053 in the last 30 days. 220 S Clinton Ave Bradley IL is a single family home that contains 1066 sq ft and was built in 1952.

Only state taxes on or measured by net income or profits are required to be added back on the Oregon return. Max manages the operations of XYZ Inc. Zestimate Home Value.

The Social Security spousal benefit reduced by the GPO of 1000 produces a spousal benefit of 250. Is an eligible employer. From a nonresident seller to withhold South Carolina income taxes from the seller.

If a calculator has printout capability the testing service must approve use of such calculator. Simply close the closing date with the drop down box. FROM - 112018 TO - 12312018.

Withholding income taxes and Federal Insurance Contributions Act FICA taxes from wages paid to another person is considered evidence of employment. And also owns all of the issued shares of the corporation. Such as taxes 81 FR 61488.

The easiest way to break this down is by an example. If a bonus was paid in a relevant baseline period a proration will generally be necessary to determine a weekly amount. TurboTax offers limited Audit Support.

The rule is also called the tax-free exclusion rule for real estate. See IRM 410815 Inadequate Records Notices. Taxable income band HKD.

Calendar Forms Lookup Meet the Assessor News Photo Gallery Save on Property Taxes. Aaron Franz 410 786-8027 or Hiilei Haru 301 492-4363 for matters related to cost-sharing reduction reconciliation. Federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15 2021 to May 17 2021.

That any such proration shall be based on Customers Service level or paid components or features in existence immediately prior to Customers election to upgrade or add paid components or features. If you are a. Estimates are also done on your TDSP charges and monthly taxes and then added to the Total Energy Charge estimate to provide your Total Estimated Bill Amount.

Insurance company filers are required to add back on Form OR-20-INS any state income taxes deducted in computing net gain from operations. IRS extends the US. It contains 3 bedrooms and 1 bathroom.

Proration of the income by reference to the number of days of their services in Hong Kong that is similar to the proration applicable to stock option benefits may also be allowed. File taxes online Simple steps easy tools and help if you need it. Then enter the local county and school tax amount and enter the tax period ie.

The Rent Zestimate for this home is 1500mo which has increased by 13mo in the last 30 days. The tax proration calculator is useful for determining the tax proration between buyer and seller. 202021 Taxable income bands for residents.

Also known as an Electric Service Identifier is a 17 or 22-digit number found on your electric bill thats assigned to your electric meters. Maxs only remuneration is a semi-annual bonus paid on January 15 and July. Retirement age of 65 with 50000 of current annual income.

The tax-free profit exclusion rule essentially says if you are single you can earn up to 250000 in tax-free profits. Nora Simmons 410 786-1981 for matters related to advance payment of the premium tax credit proration. More than 25 million individual visitors searched the website this year for information about the nearly 330000 parcels in the 720 square miles that make up the county with a total market value of more than 73.

For sale This 1945 square foot single family home has 3 bedrooms and 20 bathrooms. Taxes means all applicable transactional. Property Tax Proration Calculator Per Diem Interest Calculator.

From this last example you. Filing deadline for individuals to May 17. Use the Job Aid 965 Deferral Adjustment Calculator to compute the revised 965h installments and the future installments deferral amounts.

CSRS employees that have a relatively low Social Security benefit of lets say 300 per month the penalty would be 150. The formulas also let you calculate payroll deductions for income sources such as commission pension bonuses and retroactive pay increases. The 250000 500000 tax-free home sale profit rule is a fantastic benefit for homeowners who have lived in their homes for two out of the past five years before selling.

General Terms and 817 Choice of Law and Location for Resolving Disputes shall survive. This includes Oregon minimum tax. The IRS will be providing formal guidance in.

Bring your Offers and Bring your Fresh Ideas to finish this 4 Bedroom 2. To figure the proration rate divide the number of days you rented the home at fair rental value by the total days used for both personal and business purposes. And the buyer will pay the entire tax bill at the end of the year.

Proration is the allocation or division of money items at the closing. Treasury Department and Internal Revenue Service announced on March 17 that the US. Access Entry 000.

You can find your ESI ID number on the. Get in-depth information for expats on different taxes and how to deal with them. 1500 x 66 1000.

File with a tax pro At an office at home. The amount of withholding is determined by the kind of taxpayer and the information provided by the seller to the. Overall Spectrum customers rated them a 34 out of 5 which is ranked 4th of the 10 internet provider customers we surveyed in our study.

Zillow has 98 homes for sale in South Elgin IL. In South Carolina the home seller pays the buyers property taxes for the time the seller occupied the home for the current year. Proration mainly comes into play when a seller prepays their home taxes for the year.

As of February 2021 BroadBandNows editorial team has surveyed 283 Spectrum customers and asked them to rate Spectrum on 6 different criteria - Reliability Speed Equipment Support Interaction and Value. 4855 W School St Chicago IL 60641 is a 1945 sqft 3 bed 2 bath Single-Family Home listed for 199450. In the context of real estate we are dealing with larger numbers and dividing such things as real estate taxes homeowners association fees rents paid by tenants and so on but the concept remains the same.

Proration is the name we give to making a fair division of the costs and benefits of a financial transaction. This guide has the formulas you need to determine federal provincial except Quebec and territorial income taxes Canada Pension Plan CPP contributions and employment insurance EI premium deductions. Multiple Tax Parcels 000.

Since they paid for the full year and are selling it the buyer will then owe the seller the remaining months of taxes. Proration of Fees Fairfax County Code Section 4-172-42c Vehicles located in Fairfax County shall be liable for the Local Vehicle Registration Fee and shall be subject to monthly proration on the same basis as specified for local personal property taxes with the exception of mobile homes and other non-proratable properties. In the April 17 2018 Federal Register 83 FR 16930 2019 Payment Notice.

It is in the 60641 ZIP code in Chicago Illinois. 53517 Broker Price Opinion Comparative Market Analysis or Sales Price Estimate. Notice will be issued by the case manager and should be directed to the principal corporate officer responsible for taxes.

Real Estate Math Video 6a Prorate Real Estate Taxes 360 30 Day Method Real Estate Exam Prep Youtube

How Much Are Closing Costs When Buying A Home In Omaha Nebraska Realty

Iowa Tax Proration Calculator Apps On Google Play

Prorated Salary Easy Guide Calculator Hourly Inc

Prorating Over Time In Excel Fm

Us Sales Tax Calculator Calculatorsworld Com

Basics Of Property Taxes Mortgagemark Com

Tax Proration Texas National Title

Prorating Over Time In Excel Fm

What Is The Right Tax Proration Amount In Chicago Closings Chicago Real Estate Closing Blog

German Income Tax Calculator All About Berlin

Understanding Tax Prorations Hancock Mcgill Bleau

German Wage Tax Calculator Expat Tax

How To Compute Real Estate Tax Proration And Tax Credits Illinois

Prorated Rent Calculator Rentspree Blog

California Property Taxes Viva Escrow 626 584 9999

Sales Tax Calculator